Warrants are optional securities which give the right to buy or sell a financial asset (currencies, indices, rates, shares, etc.) under price and duration conditions defined in advance.

The Call warrant gives the right to buy at a fixed price until a given date

The Put warrant gives the right to sell at a fixed price until a given date.

The buyer of the warrant has a right to the support, called the underlying asset. If he decides to exercise his right, he can buy (Call warrant) or sell (Put warrant) the support at the exercise price, until maturity. This right is obtained for the price of the warrant.

A warrant is a negotiable product: the warrant buyer can leave it at any time by reselling it.

The buyer of a Call option has a right to buy the option, but he can leave the option without proceeding. The right to buy is not compulsory. Same thing goes for the right to sell a Put option, the buyer of a Put option has a right to buy the option, but it’s not compulsory.

As the contrary for the seller. The seller of a Call option or a Put option must proceed with the sale if the buyer wants to exercise its right to buy.

The price of a warrant is determined by the Premium made up of the time value and the intrinsic value. The Premium is equal to the intrinsic value plus the time value or P = TV + IV.

And remember, Options can be bought in multiples of 100 !

For example :

The Market price of a share is €87 on october 20th. You have the choice of purchasing a november Call option on these shares in three differnet ways as follows :

– Strike price : €86 with a premium of €4.50

– Strike price : €89 with a premium of €3.40

– Strike price : €93 with a premium of €3.20

You have a budget of €2000 and the broker’s fee is 3% of the purchase value.

What would be the best choice if the price at january 2021 option date exercise was as follow ?

– €88.00

– €94.00

– €98.00

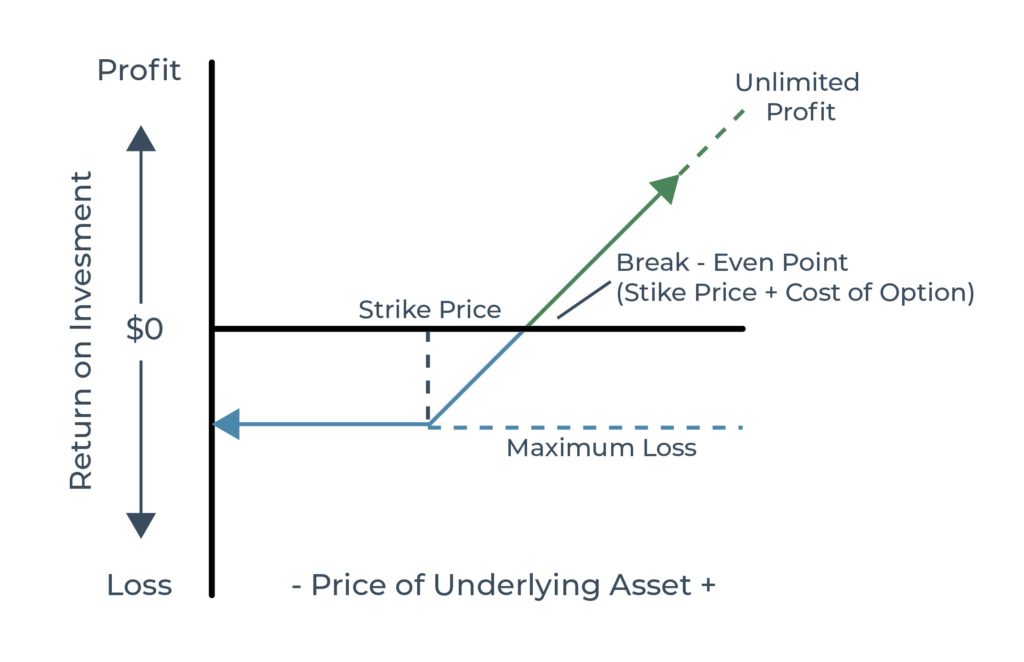

The intrinsic value of a call warrant is equal to the difference between the price of the underlying asset and the exercise price. This value can be zero or positive, three cases arise:

If the Call is in the money, it means that in this case, the price of the underlying asset is higher than the strike price, ie the intrinsic value is positive. It means that the cost of the strike price added to the premium is inferior to the value of the underlying asset. So you make a profit and you exercise your Call option

If the Call is out of the money, it means that in this case, the price of the underlying asset is lower than the strike price, ie the intrinsic value is zero. So strike price added to Premium cost is superior to the value of the underlying asset. You lose money if you exercise your Call option, so you leave it, and you just lose the Premium you paid, it’s a loss.

If the Call is at the money, it means in this case that the price of the underlying asset is equal to the strike price, the intrinsic value is also zero. You lose the cost of the Premium.

In the last two cases, holding warrants at maturity is without interest because the intrinsic value is zero and therefore the value of the warrant is zero.

If the Call is between the strike price and the break-even point, traders would still exercise their Call to minimize the loss on the Premium, even for €2 or €3 if the broker’s fee is covered.

Same goes for the Put option

The intrinsic value of a put put is equal to the difference between the strike price and the price of the underlying. This value can be zero or positive, three cases arise :

– If the Put is in the money, it means in this case the price of the underlying asset is lower than the exercise price, ie the intrinsic value is positive.

– If the Put is out of the money, in this case the price of the underlying asset is higher than the strike price, ie the intrinsic value is zero.

– If the Put is at the money in this case the price of the underlying asset is equal to the strike price, the intrinsic value is zero.

In the last two cases, holding warrants at maturity is without interest because the intrinsic value is zero and therefore the value of the warrant is zero.

Let’s go back to our example :

| 01/2021 | 01/2021 | 01/2021 | ||||

| €88 | €94 | €98 | ||||

| Call Price | Option cost | Quantity | Cost | € | € | € |

| €86 | €4.50 | 400 | € 1 854 | – 1054 | 1 346 | 2 946 |

| €89 | €3.40 | 500 | € 1 751 | 0 | 749 | 2 749 |

| €93 | €3.20 | 600 | € 1 978 | 0 | – 1 378 | 1022 |

At €88 in January 2021, you will make an intrinsic value of €2, so far so good. You have 400 options, you call them, so you expect a profit of 400*2= €800.. But the Premium costed you €1 854 ! So your loss is € 1 054 !

At €94 with a Call at €89 for 500 options, your expected profit is 500*5 = €2 500. but the Premium cost is € 1 751, so € 2 500 – € 1 751 = € 749, which is not bad at all considering the complexity of this market.

Of course, if the Call is €86 and you anticipate a underlying asset skyrocketing at €98, I urge you to expand your budget and buy 400 000 of them, which would make a profit of almost €3 millions. But quit dreaming..

Options are only allowed if you’re an experienced trader or if you have a minimum of $100,000 on your account. So, if you don’t have $100,000, your broker probably will not allow you to trade options and you have to tell them that you have some heavy experience.

Poster un Commentaire

Vous devez vous connecter pour publier un commentaire.