The services provided by an institution (i.e. the wealth manager) in order to manage the personal finances of clients (ranging from mass affluent to ultrahigh-net-worth (UHNWIs)) in order to realize individual clients goals. These goals can be diverse and will differ by individual. The products and services required to realize these goals will also differ by individual client.”

The practice of wealth management basically involves finding ways to protect and build wealth in order to pass down to generations. The generational transfer represent risks for the companies, they like to keep the assets, while the kids don’t like parent’s advisors considering them too outdated. Younger clients view technology as an important aspect.

Millennials are more likely to prefer a computer algorithm compared to a financial advisor.

Different forces driving disruption in the wealth industry : Advanced technology (blockchain, etc.) and demand for transparency (legit operations).

- Go-to-market activities : providing real-time data, news and analytics, market intelligence, product and service development, client communications and performance monitoring

- Client onboarding : using customer and behavioural data and gamification techniques to automatically identify the risk profile of clients, the loss acceptance levels, and to capture information as part of new regulatory requirements.

- Guided advice (hybrid) performs the transactions, but leaves it to relationship managers to communicate with clients. Goals based (advised), providing goal-based planning, product and investment selection, asset allocation, optimization of risk and return, and tax optimization

- Investment management : services accessible to individuals who are not yet high-net-worth individuals, it speeds up processes around decision-making, rebalancing and monitoring.

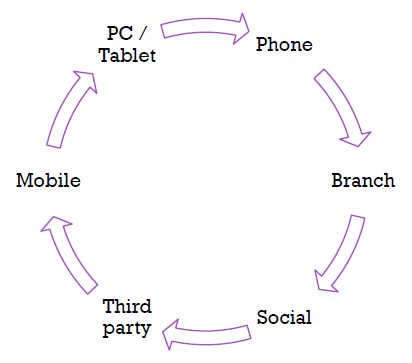

- Account administration : self-service to support 24/7, multi-channel interactions

- Ongoing relationship management : area where human interaction is typically preferred by (U)HNWIs

Wealth managers and relationships with technology :

– Partnering with traditional player

– Player buying startup

– Internal Innovation (or building) : native fintechs

Emerging technology in wealth management :

Online automated investment: robo-advisors of a new generation provides modern user experience and some decent returns. Robo-advisors have made a huge impact in the asset management industry, allowing new entrants to emerge and new services to be developed

Blockchain is the technology trigger for the disintermediation of financial services : value-added blockchain solutions range from post-trading operations, securities’ lending process, digitization as redeemable tokens, auditing and anti money-laundering (AML)/know your customer (KYC) data pipelines

Artificial intelligence : advanced AI technology that helps automate existing processes (back-office processes), predict customer journeys throughout the life cycle of their engagement, help portfolio managers make the smartest possible investment decisions

New potential jobs as Data discovery engineers, Algorithms buyer, Data cleaning team lead, Infrastructure and computer processing buyers..

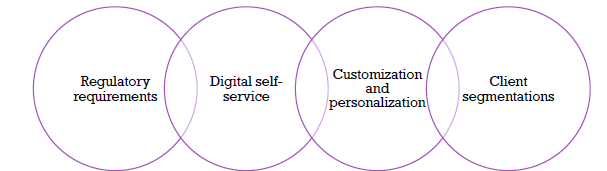

Regulatory requirements : proactive approach is prescribed to comply with each regulation : governance, legality, risk, security, data, analytics and reporting.

Digital self-service : offer more to high-net-worth (HNW) and ultra-high-net-worth (UHNW) clients while going downstream to gain business from new segment areas.

Customization and personalization : Gathering rich data that identifies customers’ behaviours, critical factor in providing targeted and relevant responsiveness.

Client segmentation : to retain current clients and gain new ones, identify,

define and understand all viable segments.

–>Millennial-minded is key for wealthTech

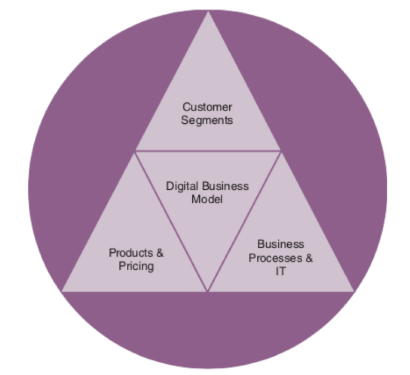

Building wealthTech applications is easy through Lego Bricks put together : -> integrating the digitization and technology available to enable new WealthTech strategies.

In a digitized WealthTech app : platforms bring together client advisory, asset management operations and platforms, and then apply artificial intelligence (AI) or programming intelligence to facilitate predictive analytics. Some players just buy start-ups rather than building their system from scratch.

General trends

– Operations costs are tremendous

– IT costs are second

– Regulation are increasing (ex : KYC Rules)

– Decentralization is increasing

– Industrialization is increasing through omni-channels management

Wealth management is also operating for each generation. The business model must align up for each individual.

The four pillars of digitalization :

– Holistic data integration,

– Open architecture and digital warehousing

– Flexible data visualization

– Hyper-personalization

Holistic data integration, open-architectural warehousing, and flexible data visualizations pillars are crucial to support digitization. Still, what clients experience is based on the degree of empathy their advisors offer them. This comes in the form of hyper- personalization.

There are 2 elements that comprise hyper-personalization :

– making the digital experience warm and personable;

– respecting clients’ individuality

When hyper-personalization is deployed, wealth managers can truly modernize their operations, becoming forward-thinking service providers who can demonstrate that they understand the individuality and needs of their HNWI clients.

Two pillars of next level digital wealth management :

– Fact-based algorithms, replacing emotion-triggered discretionary trading, avoiding also influences from greed, fear and panic.

– Precise, more efficient, automated execution of (ideally algorithm-based) trading and investment strategies.

Digitizing wealth management operations translates into offering superior services and rich experiences. This includes ensuring the confidentiality, integrity and availability of personal data and information.

Companies must have cyber resilience strategy In it the firm takes into consideration that :

– a data breach is not a matter of “if” but a matter of “when”

– people (i.e. “the human element”) are the weakest link in the cyber security chain.

The digital development of banking is split into 3 phases :

– Internal digitization (phase 1) -> automation of financial services

– Provider-oriented digitization (phase 2) -> standardization processes and application functions

– Customer-oriented digitization (phase 3) -> application of new IT developments like social media, robo-advisors, cloud computing, etc.

3 types of clients:

– Digital deniers. The client has a personal advisor and does not use any virtual banking channels.

• Hybrid client. The client has a personal advisor, but also uses virtual banking channels for services related to wealth management.

• Digitals. The client has no personal advisor and more than half of his/her wealth is with an online bank.

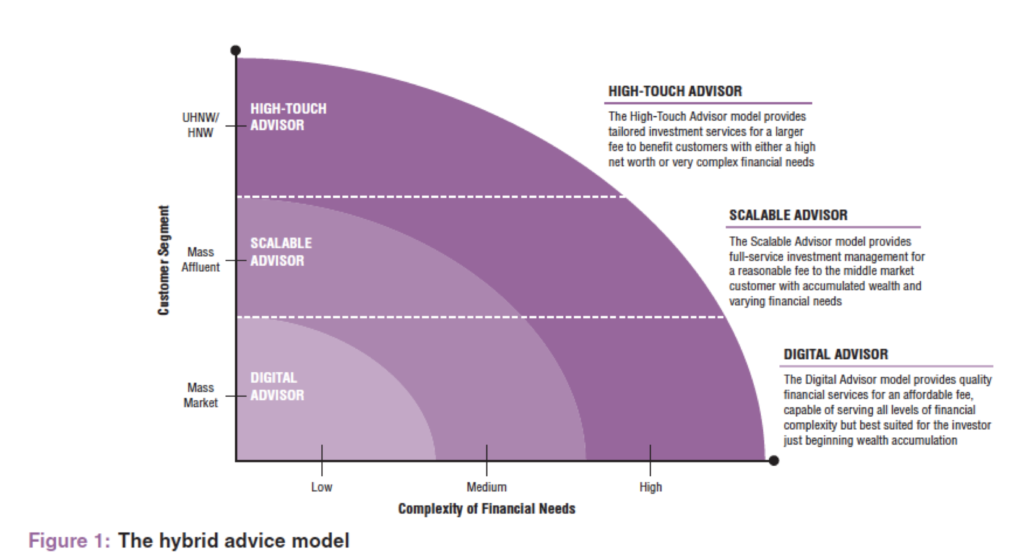

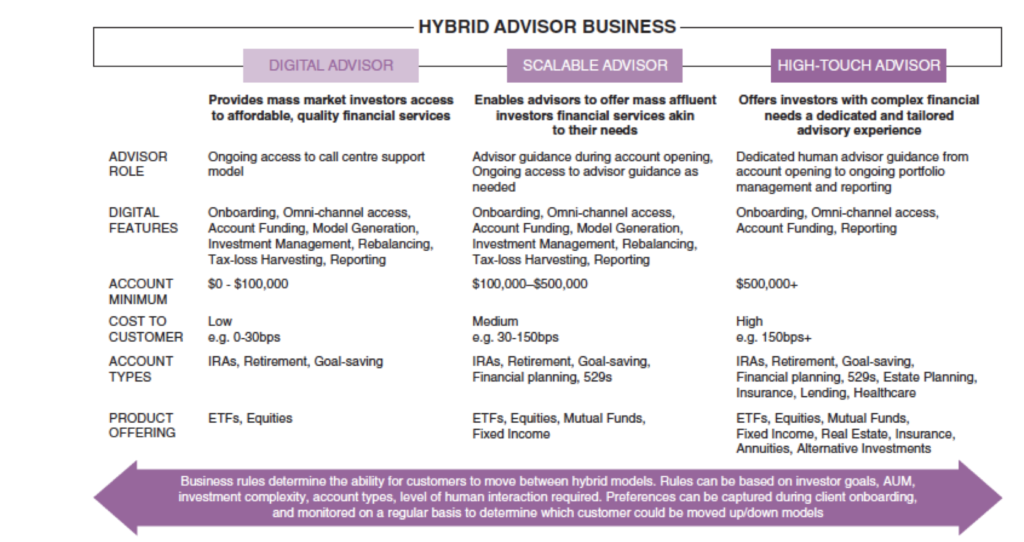

The majority of wealthy customers favour a hybrid advisory model.

Challenges in digitalizing wealth management :

The 4 steps usually performed by wealth manager :

– Understanding the client’s situation. ( risk tolerance, risk capacity

– Defining a suitable investment strategy. (portfolio with certain risk or reward characteristics, structured product strategy.)

–Recommending suitable investments. (portfolio that meets the investment strategy.)

– Controlling and monitoring the client’s wealth portfolio. (monitor the wealth portfolio and the client’s situation.

– Regulations such as MiFID 2 (the Markets in Financial Instruments Directive) are designed to ensure that the wealth manager proves that investments recommended are suitable for the client; therefore, firms have no choice but to implement repeatable processes and record evidence.

The Hybrid Advice Model

Poster un Commentaire

Vous devez vous connecter pour publier un commentaire.